The adoption of electric vehicles (EVs) has traditionally been limited by their higher initial costs. However, the landscape is shifting as environmental concerns and deteriorating Air Quality Index (AQI) levels spur consumers to embrace eco-friendly alternatives.

With these changes comes a growing discussion about how EV insurance rates compare to those of conventional Internal Combustion Engine (ICE) vehicles. This article delves into the nuanced relationship between EV ownership costs and insurance premiums, dispelling myths and uncovering the economic realities behind insuring electric vehicles.

EV Insurance Rates: The Current Scenario

A Surge in EV Adoption

According to a report by McKinsey, over 41% of Tier 1 Indian car buyers are considering EVs for their next purchase. This remarkable statistic underscores the rising interest in sustainable transport solutions among urban consumers. However, concerns persist, especially regarding insurance rates. Many fear that the sophisticated technology and expensive components of EVs may result in higher insurance premiums.

But is this apprehension justified? Let’s explore whether the cost of insuring an EV is truly prohibitive or if it can be managed through strategic choices and a deeper understanding of long-term benefits.

EV Insurance Rates: Myths vs. Reality

Structural Differences: EVs vs. ICEs

A key factor influencing insurance premiums is the structural makeup of vehicles. Comparing EVs and ICE vehicles reveals stark differences that impact overall costs:

| Aspect | Electric Vehicles (EVs) | Internal Combustion Engines (ICEs) |

|---|---|---|

| Energy Efficiency | Higher efficiency with minimal loss | Significant energy loss due to heat and friction |

| Number of Parts | ~20 movable parts | ~200 movable parts |

| Environmental Impact | Zero emissions | High pollution levels |

| Maintenance Costs | Lower running and maintenance costs | Higher due to complex components |

The simplicity of EV design, combined with lower running costs, helps offset the higher insurance premiums associated with their upfront purchase price. Additionally, as EVs are inherently eco-friendly, they align with increasing societal and governmental emphasis on reducing carbon footprints.

“The long-term economic advantages of EVs lie not just in fuel savings but also in reduced maintenance and operating costs, making them a smart choice for discerning buyers.”

The Impact of Purchase Cost on Insurance Premiums

One of the primary reasons for higher EV insurance rates is their elevated purchase price, which directly influences the Insured Declared Value (IDV). A higher IDV translates to increased premiums. Nevertheless, proactive governmental measures are helping bridge this gap.

Key Government Initiatives Supporting EV Adoption

The Indian government has taken significant steps to make EVs more accessible:

- Budgetary Allocations:

- INR 35,000 Cr was earmarked in the 2023–24 Union Budget for initiatives targeting net-zero emissions.

- Funding for the FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme was increased by 80%.

- State-Level Incentives:

State governments have introduced subsidies and incentives for electrifying public transportation fleets, encouraging widespread EV adoption.

| Vehicle Category | Approximate Incentives |

|---|---|

| Two-Wheelers | Up to ₹15,000 per unit |

| Four-Wheelers | Up to ₹1.5 Lakhs per unit |

| Public Transport EVs | Significant subsidies available |

Such incentives help mitigate the upfront cost barrier, indirectly reducing insurance costs by lowering the overall financial burden on buyers.

Calculating Third-Party Premiums for EVs

Understanding kWh: A Key Metric

Third-party insurance premiums for EVs are calculated based on their kilowatt-hour (kWh) rating. The kWh metric represents the energy capacity or consumption of a vehicle over time.

Formula:

Energy (kWh) = Power (kW) × Time (1 hour)

For example, the MG EV, with a power output of 142.7 PS (106.5 kW), will have its premium determined based on this power rating. By aligning premiums with energy efficiency, insurers aim to create a fair cost structure that reflects the vehicle’s capabilities.

Reducing EV Insurance Rates

While the long-term cost-efficiency of EVs is evident, there are several strategies buyers can employ to lower their insurance premiums:

Top Tips to Cut EV Insurance Costs

- Purchase Insurance Online:

Comparing policies online allows you to identify the most cost-effective plans tailored to your needs. - Opt for Voluntary Deductibles:

Agreeing to pay a portion of claim expenses can significantly lower your premium. - Install Security Features:

Vehicles equipped with anti-theft devices and safety locks often qualify for reduced premiums. - Leverage No-Claim Bonuses:

Avoiding claims during a policy term can earn you a no-claim bonus, reducing subsequent premiums.

“Smart planning and leveraging available discounts can make EV insurance not only affordable but also a worthwhile investment in sustainable mobility.”

What the Future Holds

Technological Advancements and Economies of Scale

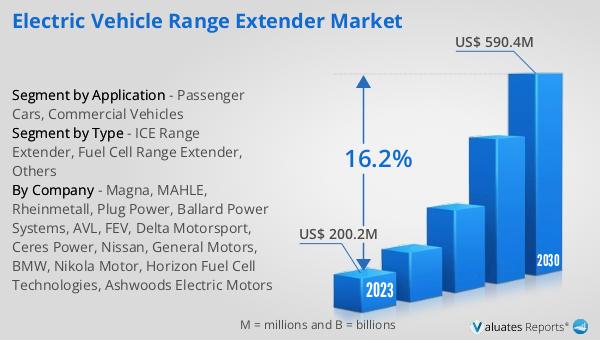

As EV technology continues to evolve, the associated costs are expected to decline. Here’s how:

- Battery Innovations: Advances in battery design and materials will reduce manufacturing expenses, enhancing affordability.

- Economies of Scale: Increased production volumes will drive down unit costs, making EVs—and their insurance—more accessible.

- Market Competition: Growing competition among automakers will lead to cost reductions, benefiting consumers.

Projected Benefits for EV Insurance:

- Reduced vehicle prices will lower IDVs, subsequently decreasing insurance premiums.

- Simplified designs and fewer moving parts will minimize repair costs, further reducing premiums.

Conclusion

The narrative around EV insurance rates is gradually shifting from skepticism to optimism. While the upfront costs may seem daunting, the long-term benefits—including reduced running costs, lower maintenance expenses, and government incentives—paint a compelling picture for prospective EV buyers.

As the industry advances and adoption rates soar, EV insurance is poised to become not just competitive but also a critical enabler of sustainable mobility. By understanding the dynamics of EV ownership and leveraging strategies to reduce insurance costs, buyers can embrace the future of transportation with confidence and clarity.

“In the evolving automotive landscape, electric vehicles represent not just a choice, but a commitment to a greener, more sustainable future.”